Embarking on the journey to explore the realm of Best Health Insurance for Freelancers in 2025, this introduction aims to captivate readers and immerse them in the upcoming trends and considerations in the world of health insurance for freelancers.

As we delve deeper into the intricacies of health insurance options for freelancers, the landscape is evolving to meet the changing needs and preferences of this dynamic workforce.

Factors Influencing Health Insurance Choices

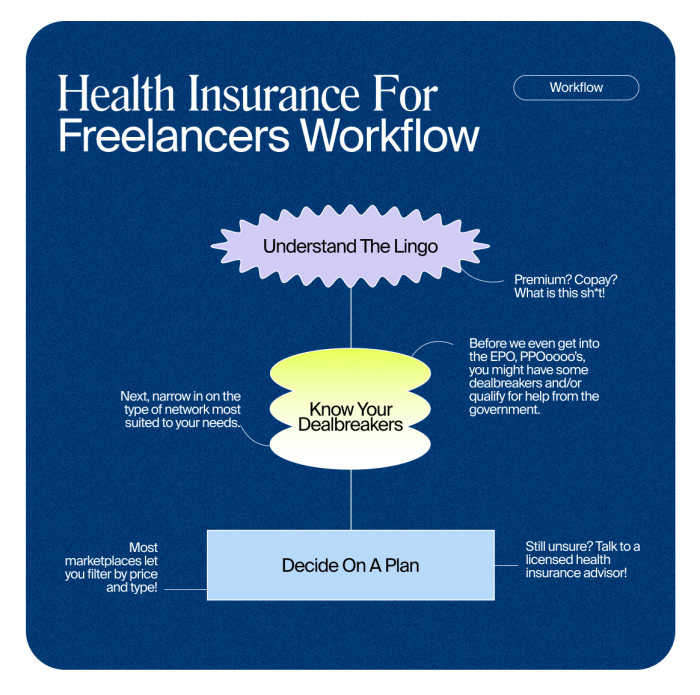

When freelancers are selecting health insurance, several key factors come into play. These factors can greatly impact their decision-making process and ultimately determine the best health insurance for their unique needs.

Cost

Cost is a major consideration for freelancers when choosing health insurance. In 2025, the rising cost of healthcare may continue to be a significant factor influencing their decisions. Freelancers may prioritize finding affordable plans that fit within their budgets while still providing adequate coverage.

Coverage

Coverage is another crucial factor for freelancers. In 2025, with evolving healthcare needs and advancements in medical treatments, freelancers may seek comprehensive coverage that includes a wide range of services such as telemedicine, mental health support, and preventive care. Access to a broad network of healthcare providers may also be a priority for freelancers in the coming years.

Flexibility

Flexibility in health insurance options is important for freelancers who often have unpredictable income streams and changing work arrangements. In 2025, freelancers may value plans that offer flexibility in terms of coverage levels, provider choices, and the ability to adjust their plans as needed without incurring heavy penalties.

Benefits

Beyond the basics, freelancers may also consider additional benefits offered by health insurance plans. In 2025, benefits like wellness programs, maternity care, and alternative therapies may become more sought after by freelancers looking to prioritize their overall well-being and address specific health concerns.

Emerging Health Insurance Trends

As we look towards the future of health insurance for freelancers, several emerging trends are shaping the landscape of coverage options available. These trends are not only innovative but also cater to the unique needs of freelancers in a rapidly changing work environment.

Innovative Health Insurance Offerings

Insurance providers are now offering tailored plans specifically designed for freelancers, taking into account their fluctuating income and variable work schedules. These plans often provide more flexibility in terms of coverage and payment options, allowing freelancers to customize their insurance to fit their individual needs.

Technology Advancements in Health Insurance

Advancements in technology are revolutionizing the way health insurance is accessed and managed by freelancers. Telemedicine services, wearable health devices, and health tracking apps are becoming more integrated into insurance plans, allowing freelancers to conveniently monitor their health and access care remotely.

This not only improves access to healthcare but also promotes preventive care and overall well-being.

Comparison of Top Health Insurance Providers

When it comes to choosing the best health insurance provider as a freelancer in 2025, it's crucial to compare and contrast the top options available. Evaluating the strengths and weaknesses of each provider's offerings can help you make an informed decision.

Additionally, analyzing customer satisfaction ratings and reviews for leading health insurance companies can give you valuable insights into the quality of service provided.

Provider A

- Strengths:

- Extensive network of healthcare providers

- Comprehensive coverage options

- Weaknesses:

- Higher premiums compared to competitors

- Limited customer service support

- Customer Satisfaction:

- Positive reviews regarding coverage benefits

- Complaints about claim processing times

Provider B

- Strengths:

- Affordable premium rates

- Flexible plan options

- Weaknesses:

- Limited network of healthcare providers

- Restrictions on pre-existing conditions coverage

- Customer Satisfaction:

- Mixed reviews on customer service quality

- High satisfaction with claim processing efficiency

Provider C

- Strengths:

- Innovative digital health tools

- Personalized wellness programs

- Weaknesses:

- Higher deductibles and out-of-pocket costs

- Complex plan structures

- Customer Satisfaction:

- High ratings for preventive care services

- Complaints about lack of transparency in billing

Customized Health Insurance Solutions

When it comes to health insurance for freelancers, having a customized plan can make all the difference in ensuring adequate coverage and peace of mind. Tailoring health insurance to meet the unique needs of freelancers can offer several benefits and advantages.

Benefits of Customizing Health Insurance for Freelancers

- Flexibility in coverage options to suit varying income levels and individual health needs.

- Ability to add or remove specific benefits such as maternity coverage, mental health services, or vision care based on personal requirements.

- Opportunity to choose a network of healthcare providers that align with the freelancer's preferences and accessibility.

- Possibility to adjust deductibles, copayments, and coinsurance to create a plan that fits within the freelancer's budget.

Recommendations for Insurance Providers

- Offer tiered plans with different levels of coverage to cater to freelancers with varying financial capabilities.

- Create packages that include essential services often needed by freelancers, such as telemedicine and preventive care.

- Provide transparent pricing and easy-to-understand policy details to help freelancers make informed decisions about their coverage.

- Partner with freelancer communities or platforms to reach out directly to this workforce and understand their specific insurance needs better.

Concluding Remarks

Concluding our discussion on Best Health Insurance for Freelancers in 2025, it's evident that the future holds promising developments in the realm of tailored health insurance solutions for freelancers. As we navigate through the intricacies of cost, coverage, and flexibility, one thing remains certain - the importance of prioritizing health and well-being in the freelance landscape.

Questions and Answers

What factors do freelancers consider when choosing health insurance?

Freelancers typically prioritize factors such as cost, coverage, flexibility, and benefits when selecting health insurance plans.

How are changing trends and needs expected to impact health insurance choices in 2025?

Changing trends and needs in 2025 may lead to a greater emphasis on customizable and flexible health insurance solutions tailored to freelancers.

Can you provide examples of innovative health insurance offerings for freelancers?

Innovative health insurance offerings for freelancers may include on-demand healthcare services, virtual consultations, and personalized wellness programs.

Which health insurance provider stands out for freelancers in 2025?

Each provider has its strengths and weaknesses, but some popular choices for freelancers in 2025 include Aetna, UnitedHealthcare, and Cigna.

How can insurance providers better cater to the freelance workforce?

Insurance providers can enhance their offerings by providing more customizable plans, transparent pricing, and improved access to healthcare services for freelancers.