Beginning with “Health & Hazard: Dual Coverage Plans for Small Companies”, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

In this discussion, we will delve into the intricacies of dual coverage plans for small companies, exploring how they can provide comprehensive protection against health and hazard risks.

Introduction to Dual Coverage Plans

Dual coverage plans in the context of health and hazard insurance refer to policies that provide coverage for both health-related issues as well as potential hazards or risks that may arise in a business setting. These plans offer a comprehensive approach to insurance, combining two essential aspects into one policy.

The benefits of dual coverage plans for small companies are significant. By having both health and hazard coverage in one plan, small businesses can streamline their insurance processes, reduce administrative costs, and ensure that they are adequately protected in case of any unforeseen events.

Mitigating Risks for Small Businesses

Dual coverage plans can help small companies mitigate risks in various ways. For example, by having health coverage included, employees can access medical care when needed, reducing absenteeism and promoting a healthier workforce. On the other hand, having hazard coverage can protect the business from financial losses due to property damage, liability claims, or other unforeseen events.

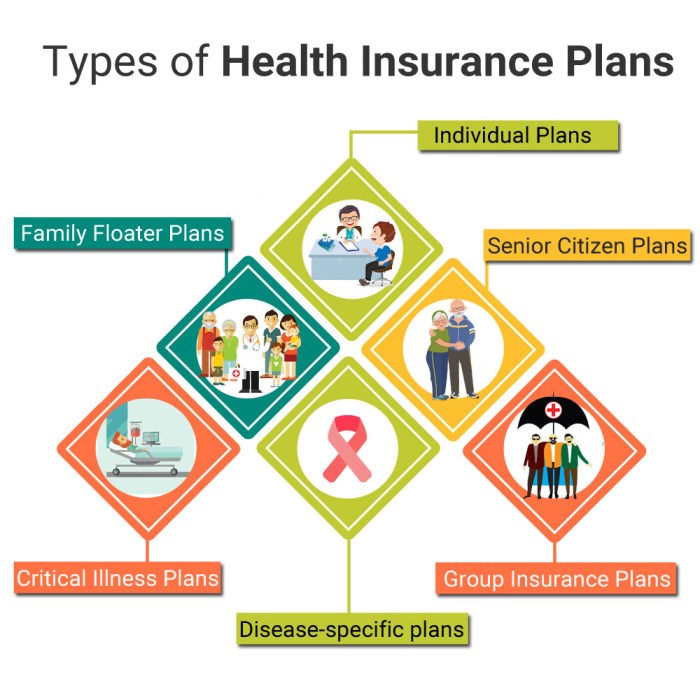

Importance of Health Insurance for Small Companies

Health insurance plays a crucial role in the success and well-being of employees in small businesses. By providing health coverage, employers not only demonstrate care for their team members but also gain numerous benefits that contribute to the overall growth of the company.

Attracting and Retaining Top Talent

Offering health insurance can be a significant factor in attracting top talent to small companies. In a competitive job market, candidates often prioritize companies that provide comprehensive health benefits. Additionally, once hired, employees are more likely to stay with a company that offers health insurance, leading to increased retention rates.

Impact on Employee Satisfaction and Productivity

Studies have shown that access to health insurance leads to higher levels of employee satisfaction and productivity. When employees have the security of knowing their health needs are covered, they are more focused on their work and less stressed about medical expenses.

This results in a more engaged and motivated workforce, ultimately benefiting the company's bottom line.

Overview of Hazard Insurance for Small Companies

Hazard insurance is a type of coverage that protects small businesses from financial losses due to unexpected events or disasters. It is essential for small companies to have hazard insurance to safeguard their assets and ensure business continuity.

Common Hazards Faced by Small Companies

- Natural disasters such as floods, earthquakes, hurricanes, and wildfires can cause significant damage to small businesses.

- Fire outbreaks in the workplace can lead to property damage, inventory loss, and business interruption.

- Burglaries, vandalism, and theft can result in financial losses and disrupt daily operations.

Impact of Hazard Insurance Claims on Small Businesses

Hazard insurance claims play a crucial role in helping small companies recover from unforeseen events and minimize financial burdens. For example, if a small retail store experiences a fire and has hazard insurance coverage, the policy can help cover the costs of repairing the damage, replacing inventory, and compensating for lost revenue during the closure.

Integration of Health and Hazard Insurance

Integrating health and hazard insurance into a dual coverage plan is a strategic approach that offers comprehensive protection for small companies and their employees. By combining these two types of insurance, businesses can mitigate risks associated with both health-related issues and potential hazards that may affect their operations.

Benefits of Dual Coverage Plans

- Comprehensive Protection: Dual coverage plans provide a broad spectrum of coverage, addressing both health-related concerns for employees and potential hazards for the business.

- Cost-Effectiveness: Combining health and hazard insurance can often result in cost savings compared to purchasing separate plans, making it a more efficient option for small companies.

- Streamlined Administration: Managing a single dual coverage plan simplifies administrative tasks for employers, reducing the complexity of dealing with multiple insurance policies.

Structuring a Dual Coverage Plan

- Assessing Needs: Begin by evaluating the specific health and hazard risks faced by the company and its employees to determine the appropriate coverage levels.

- Customizing Coverage: Work with insurance providers to tailor the dual coverage plan to meet the unique needs of the business, ensuring adequate protection against identified risks.

- Employee Education: Communicate the details of the dual coverage plan to employees, helping them understand the benefits and coverage options available to them.

- Regular Review: Periodically review and adjust the dual coverage plan to reflect any changes in the company's operations, workforce, or risk factors, ensuring ongoing relevance and effectiveness.

Outcome Summary

In conclusion, the integration of health and hazard insurance into dual coverage plans offers small companies a strategic advantage in managing risks and ensuring the well-being of their employees. With the right approach, these plans can pave the way for a more secure and stable future for businesses of all sizes.

Essential Questionnaire

What are dual coverage plans?

Dual coverage plans combine health and hazard insurance to provide comprehensive protection for small companies against various risks.

How can dual coverage plans benefit small companies?

Dual coverage plans offer small companies a cost-effective way to manage both health and hazard risks, ensuring the well-being of employees and protecting the business from financial losses.

Why is health insurance important for small companies?

Health insurance is crucial for attracting and retaining top talent, as well as enhancing employee satisfaction and productivity within small businesses.

What is hazard insurance and why is it relevant to small companies?

Hazard insurance protects small companies against various risks such as property damage, liability issues, and natural disasters, safeguarding the business from financial losses.